WELCOME TO THE VAULTX FAQ

Here Are The Most Frequently Asked Questions.

Ask in one of our community channels only if you do not find the information you seek here. Never give out your personal private information to anyone.

The DBR is short for Duration Bonus Rate which is part of the mining rate reward calculation that increases the reward per second of commitment time of your Vault. It works like this: instead of taking the rate X number of seconds in the commitment, the rate is exponentially raised based on the number of seconds in the commitment. In other words, longer commitments actually pay better than shorter commitments instead of just adding up the rate for all the seconds as we’ve seen in other protocols. This

Duration formula

The TLDR here is the longer a user stakes a CryptoVault for, the reward rate increases upon an exponential curve.

DBR: Duration Bonus Rate

The formula used to calculate the bonus interest rate considers the staking duration (length of the commitment) and applies a power function and multiplication to yield the bonus rate.

The ‘Duration Ratio ‘is computed first with this formula:

Duration Ratio = Stake Duration / Maximum Duration

- Stake Duration: The duration for which the user commits to stake their tokens.

- Maximum Duration: The maximum staking duration permitted by the protocol.

This ratio describes how long a given stake is relative to the maximum possible duration.

Calculation of the Bonus Interest Rate:

The bonus interest rate is then calculated with this duration ratio using the formula:

Bonus Rate = (Duration Ratio)^(Bonus Rate Exponent) * Maximum Bonus Rate

- Duration Ratio: Computed previously.

- Bonus Rate Exponent: A parameter set within the system to adjust the curve of bonus interest rates as they relate to stake duration.

- Maximum Bonus Rate: The highest possible bonus interest rate available within the protocol.

This formula has an exponential relationship between the stake duration and the bonus interest rate. As the duration ratio increases, the bonus interest rate grows exponentially up to the maximum bonus interest rate. The degree of this exponential growth is regulated by the Bonus Rate Exponent.

Overall, this method of calculating the bonus interest rate encourages long-term staking within the VaultX platform. It rewards users who are invested in the long-term success of the VaultX token economy, enhancing stability by locking up tokens and reducing circulating supply.

Base Interest Rate:

The base interest rate is a fundamental component of the VaultX platform’s interest calculation, playing a key role in determining the returns from staking. This rate is intricately designed to adjust based on the circulating supply of VaultX tokens in the ecosystem, thus ensuring a dynamic and adaptive staking model.

The calculation involves a number of steps:

-

Total Supply and Locked Supply

The system first identifies the total supply of VaultX tokens and the amount that is currently locked within the contract. The total supply is obtained directly from the VaultX token contract. The locked supply is the amount of VaultX tokens currently held by the contract, which represents the tokens that are currently staked.

-

Circulating Supply

The circulating supply is calculated by subtracting the locked supply from the total supply. This represents the VaultX tokens available in the open market.

-

Circulating Ratio

This ratio represents the proportion of VaultX tokens currently in circulation relative to the total supply. It is expressed in basis points (bps), where 1 basis point is equal to 0.01%. For example, if 50% of the total VaultX tokens are in circulation,

then the circulating ratio is 5000 bps.

-

Base Interest Rate Calculation :

Lower Limit: If the circulating ratio is less than or equal to a predetermined minimum, the base interest rate is set to the minimum base interest rate defined by the system.

Upper Limit: If the circulating ratio is above the minimum but below or equal to 100% (i.e., all tokens are in circulation), a decrease factor is calculated. This factor is the product of the base interest rate and the difference between the maximum basis points (10000) and the circulating ratio. This product is then divided by the difference between the maximum basis points (10000) and the minimum circulating ratio. The base interest rate is then decreased by this factor.

Stake Duration: The base interest rate is then multiplied by the stake duration in seconds and divided by the total seconds in a year (31,536,000 seconds for a non-leap year). This annualizes the interest rate, providing a yearly return rate based on the staking period.

The final result is the base interest rate for the stake. It adapts to the circulating supply of VaultX tokens and the duration of the stake, promoting a dynamic, market-responsive model for staking returns.

By tying the base interest rate to the circulating supply, the system incentivizes users to stake their tokens, as more circulating tokens mean lower base interest rates. Similarly, the dependence on stake duration motivates longer-term staking, as users gain more by staking for longer periods.

Total supply

The Total Supply at the time of contract creation is 100 Billion VaultX tokens. The total supply can deflate or inflate based on users’ interactions with the protocol. The total increase or decrease in supply (Inflation or deflation) is limited by our Base rate and Duration Bonus Rate reward algorithms.

CryptoVault Utility NFTs

CryptoVaults are Utility NFTs allowing users to mine their own rewards. When a user stakes using VaultX, a CryptoVault Utility NFT is created containing the staked tokens. NFT is a liquid staking asset and can be redeployed in other cryptocurrency protocols.

Liquid staking derivatives represent a user’s staked assets via another ERC-20 or the VaultX ERC-721 Utility NFT way. These tokens can be used in a variety DeFi protocols, enabling them to earn an additional yield on top of their staking rewards.

Yes, CryptoVaults are a type of Liquid staking derivative. CryptoVaults are interoperable with any EVM-compatible protocol.

CryptoVault holders instantly gain access to the custom portfolio analytics dashboard, made to track P/E, ROI, and Trends. The dashboard is a suite of tools to help you make the best decisions in crypto.

A LuckyVault NFT is any vault ID number ENDING in 7,77 or 777. Claim a bonus from the prize pool for minting one.

Early termination fees are proportioned to the LuckyVault prize pool and along with the VaultX treasury established to cover operational expenses.

There are no platform fees for using the protocol. However, if a user chooses to terminate their CryptoVault before the maturity date an early termination fee is assessed. Termination fees range based on how many days of the stake you’ve completed divided by the total commitment time.

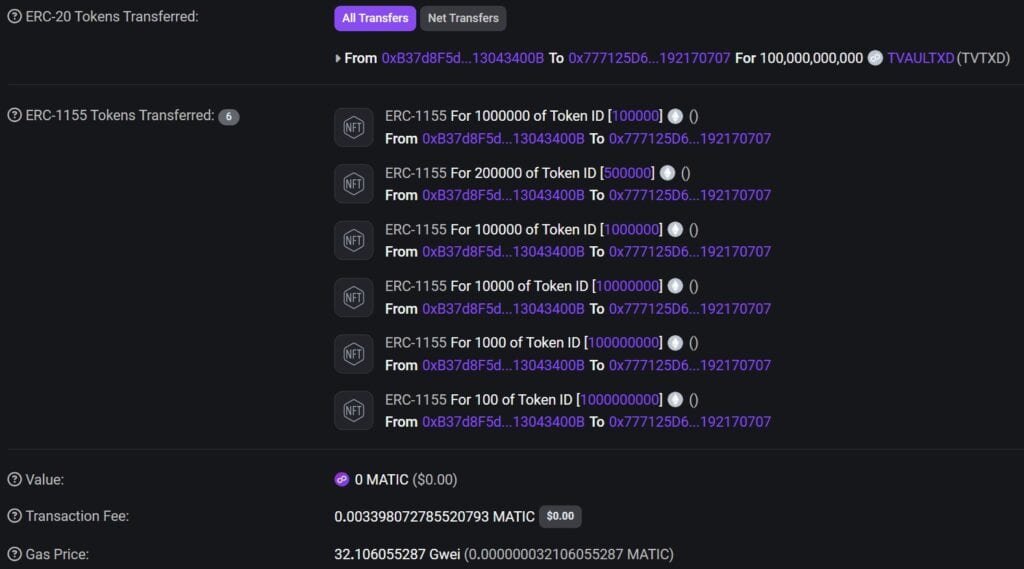

https://polygonscan.com/tx/0x3e249c8ec18bcc185db2fb83c22502be1680d40028c7e8ed10ac3cfcf115c2ad

ERC-20

ERC-1155