VaultX is the Solution for:

👆 ClickTo Expand

How VaultX Works

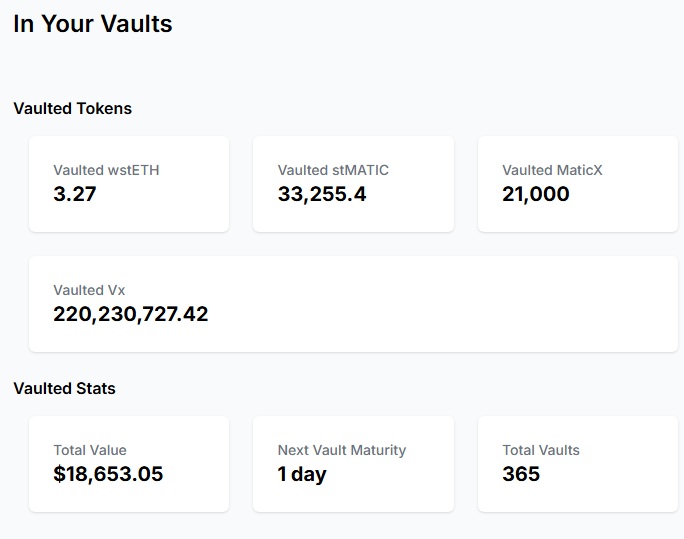

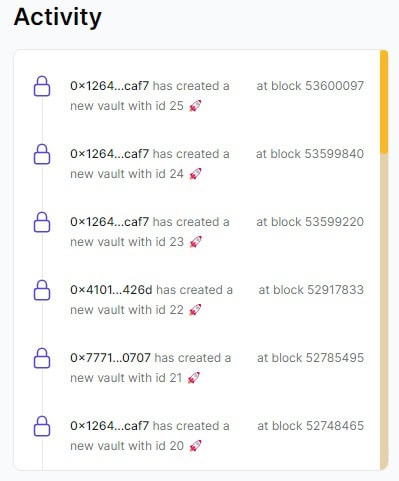

Each CryptoVault (CVx) represents a unique stake.

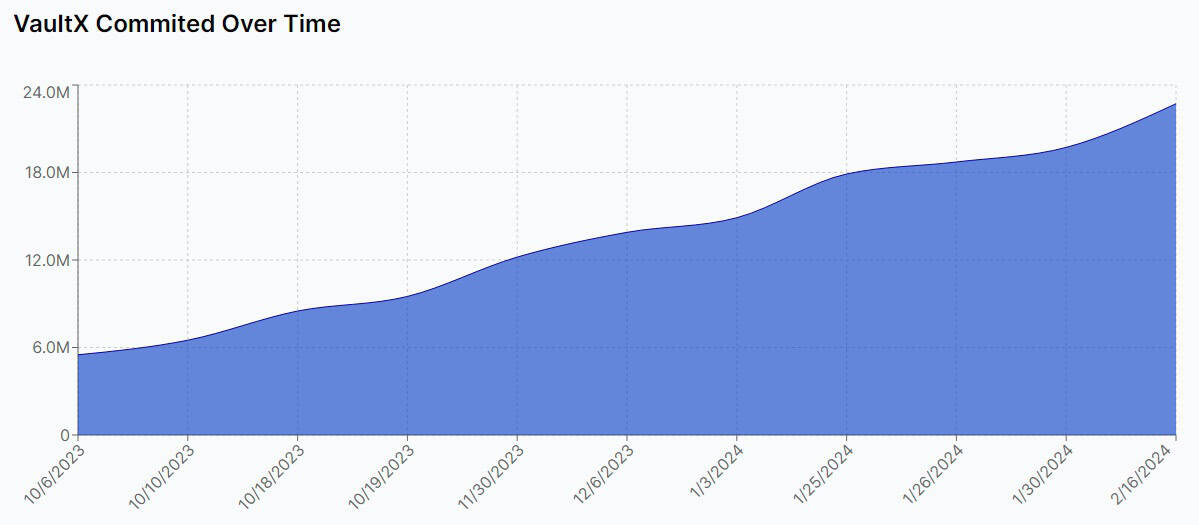

The EVM AI sets a new rate every time someone stakes or unstakes.

It raises rates to attract new stakers….

…then lowers rates to make existing stakes more desirable.

The ultimate AI driven flywheel to increase demand in both directions.

Step 1 > > >

Invest in Your Future

Convert your native POL/ETH into a Vault with your choice of LSD and earn VaultX Tokens

Step 2 > > >

Secure Your Assets

Receive your CryptoVault as an NFT (ERC-721 Token), combining security with versatility

Step 3 > > >

Amplify Your Earnings

Your LSDs now earn Vx tokens, enhancing your yield while remaining usable in NFT protocols like OpenSea

VAULTX is a New Hybrid Token #ERC-2055

ERC-20

ERC-20

ERC-1155

ERC-1155

WORLDS FIRST DENOMINATED CRYPTO #ERC-2055

DIGITAL DENOMINATION DOMINATION

Future Supply Forecasting

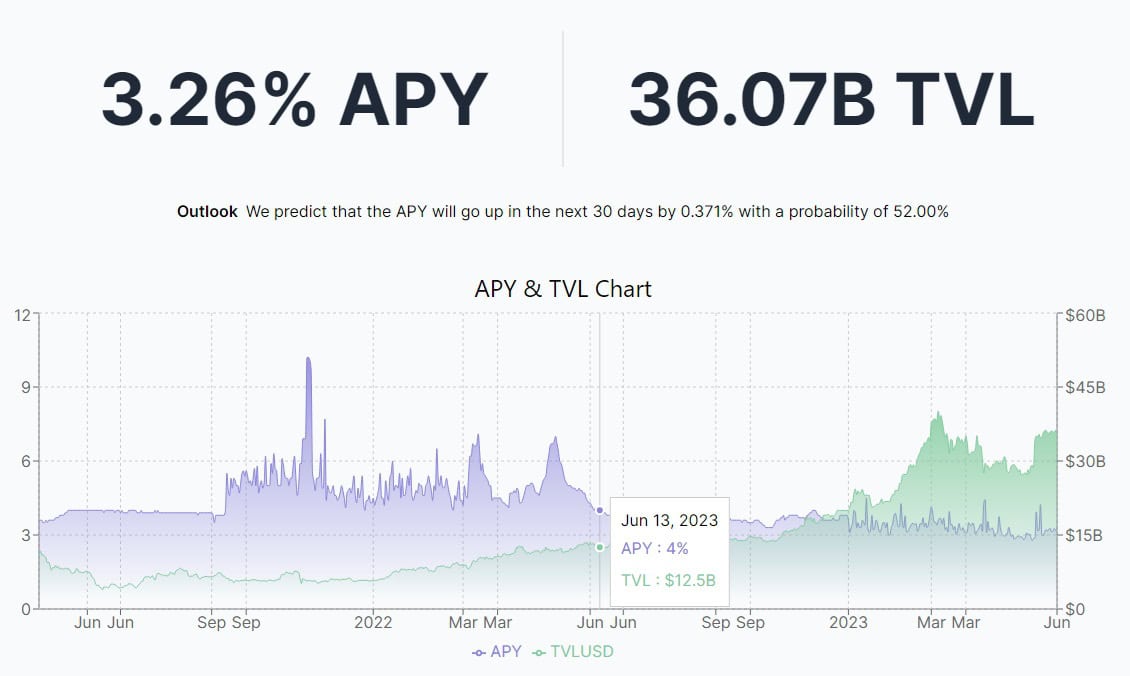

Easy LSD Analytics

Easy LSD Analytics

👆 ClickTo Expand

Look Inside a CryptoVault

👆 ClickTo Expand

AI: Advanced Staking System

👆 ClickTo Expand

VaultX Blog

From the blog

Join the VaultX Community

Join the Discord in VaultX Discord

Tell us on Telegram

Join the Flock

We even have an Instagram!